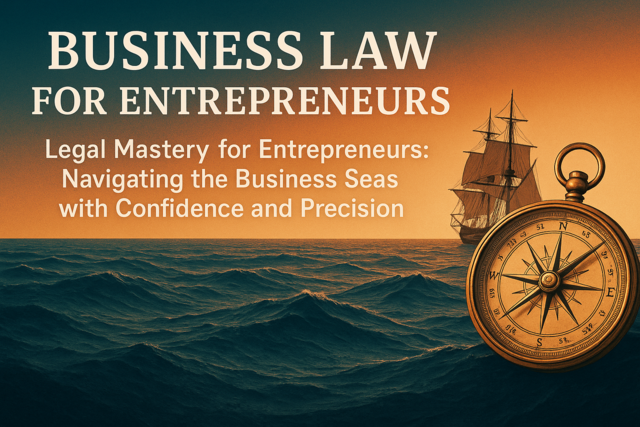

Business Law for Entrepreneurs

Empower Your Business Journey with Legal Confidence

7 Hours average completion time

0.7 CEUs

14 Lessons

28 Exams & Assignments

5 Discussions

28 Reference Files

49 Articles

Mobile Friendly

Last Updated October 2025

Legal Mastery for Entrepreneurs: Navigating the Business Seas with Confidence and Precision

In the vast ocean of entrepreneurship, tides of opportunity often come with waves of legal challenges. Ensuring your ship is not only seaworthy but also compliant with maritime laws can be the difference between sailing towards sunrise or getting lost in a storm. This course is your astrolabe, guiding you through the intricate labyrinths of business legality, ensuring that you not only sail but thrive.

Here's Why This Course is Your Business Beacon:

- Strategic Business Structuring: Dive into the depths of business operational structures. Grasp the nuances of structuring your enterprise for optimal legal safety and tax efficiency.

- Capital Crusades: Unlock secrets to sourcing startup capital and venture capital. Learn to propel your venture from a dream sketch to a towering reality.

- Your Legal Shield: Safeguard your entrepreneurial journey. Navigate through employment law intricacies, ensuring you master the art of ethical and legal hiring and firing.

- Taxation & Liability Tapestry: Unravel the intricate web of taxation requirements. Ensure your venture is not only profitable but also compliant. Discover the shields of liability insurance, guarding your enterprise against unforeseen financial storms.

- Contractual Command: Gain proficiency in contract crafting and interpretation. Learn to seal deals that serve and safeguard your business interests.

- Valuation and Exit Ventures: When it's time to set sails for new horizons, ensure your vessel fetches its true value. Master the science and art of business valuation and the strategic process of selling.

Course Highlights & Offerings:

- Empowered Decision Making: Learn the decisive factors for a seamless transition from being an employee to an empowered entrepreneur.

- Risk Mitigation Magic: Steer clear of lurking dangers, learn to protect your assets, and know the crucial steps to avert the whirlpool of bankruptcy.

- End-to-End Coverage: From the birth of a business idea to the eventual transition towards newer ventures, every stage is meticulously covered.

A Visionary's Guide to Business Longevity:

The tapestry of entrepreneurship is woven with threads of vision, courage, and legal wisdom. While many embark on this journey, those equipped with the right legal knowledge and strategic foresight are the ones who etch legends.

With this course, your business dream doesn't remain a mere vision; it transforms into a carefully crafted plan, anchored in legal wisdom, ready to weather challenges and seize opportunities. As esteemed business thinkers advocate, enduring businesses are meticulously planned edifices, not hastily built sandcastles.

So, if you are a budding entrepreneur or an established business owner aiming for the stars, this course is your star map. Illuminate your path, ensure your venture's longevity, and leave no stone unturned in your quest for entrepreneurial excellence. Embark on this enlightening journey and let's co-create your business legacy.

- Insurance coverage decision-making

- Intellectual property protection

- Strategic business structuring

- Tax compliance understanding

- Legal hiring and firing mastery

- Bankruptcy risk mitigation

- Employment law navigation

- Contract crafting proficiency

- Business valuation techniques

- Risk and liability assessment

- Capital sourcing strategies

Choose from plans starting at just $16/month (billed annually)

See Your Team Succeed

Empower your team instantly with an integrative group enrollment system. Purchase licenses in bulk with Group Discounts.