Setting Up QuickBooks 2014

QuickBooks is an accounting software program created by Intuit for small businesses and self-employed professionals. You can purchase the QuickBooks software online from Intuit or other vendors, and you can also purchase it in some stores. The purpose of QuickBooks is to give businesses the power to do all of their own accounting -- including invoicing, payroll, and paying bills -- right from the convenience of a desktop computer, possibly eliminating the expense of a full time accountant.

QuickBooks can be used for almost all financial business processes. You can use it for entering receipts, tracking expenses, invoicing, payment tracking, tax tracking, purchase orders, and even to prepare reports and statements regarding your finances. The QuickBooks software also allows you to print your own checks. This means you can print employees' payroll checks and use the software to track the time they've worked. Because it was created for small businesses, it makes the task of "keeping the books" a lot easier and automated.

Indeed, QuickBooks can almost serve as your small business's accountant. Of course, nothing replaces the legal and financial advice a qualified CPA can give you, but for the tasks listed above, QuickBooks can handle the job -- even if you don't understand accounting procedures. This means if you are bad at math, aren't really sure how to "keep the books," or really how to do anything on the financial side of your business, QuickBooks can do most of it for you. That's why it is great for small businesses that maybe can't afford the costs of a full time accountant or bookkeeper. And when you factor in how easy it is to use, it's safe to say your company will fall in love with this software.

Since the QuickBooks software can be viewed as expensive, if you choose to buy it. Think of it like learning about the Civil War in school. You learned what happened, you learned the facts, but you didn't (and couldn't) actually go witness it and participate.

Does a Small Business Need QuickBooks?

If you are a savvy business owner who doesn't like to spend money on things you really don't need -- or wants to keep things as simple as possible, you may think you don't even need QuickBooks. Perhaps you are a very small business without any (or many) employees. Or you think you just don't need an accounting system, because there's not enough money to count. Most likely, you couldn't be more wrong.

Did you know federal law requires that you have an accounting system in place for your business? You are required, as a business, to have the ability to account for your taxable income. You must use an accounting system that will reflect your income.

Of course, you can ignore this and do things your way. You may never get caught. But remember, if the U.S. Internal Revenue Service ever decides to audit your business, and you don't have an accounting system in place that clearly shows your income (and how you came up with the numbers), they will then do accounting using their system. It is almost a guarantee that their system will cost you more.

But there's another reason, aside from the IRS. You want your business to grow, don't you? You want to be a savvy business owner who makes wise choices, right? A good accounting system, such as QuickBooks, will help you measure profits and losses. It will shed some light on what you are doing that works; it'll show trends, and even help you make better purchases by managing your inventory.

Which Version of QuickBooks Is Right for Your Company?

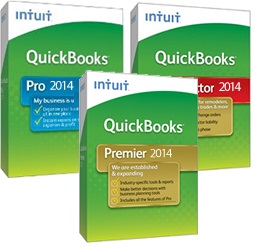

There are three versions of QuickBooks out on the market. The version you use will depend on your business and what you need from the QuickBooks software. We have listed the versions below, so you can make sure the version you use is the right one for your business.

-

QuickBooks Pro is the basic version of QuickBooks. That's not to say it has stripped-down features, though, because it doesn't. With QuickBooks Pro, you can complete tasks faster than before, with simplified customer forms, as well as sort customer, vendor, and employee information into lists to make invoicing, paying bills, and payroll as simple as clicks of the mouse.

-

QuickBooks Premiere. With Premiere, you get all the features of Pro plus you get advanced reporting, including the ability to view customized sales and profitability reports. In addition, you can run "Cost to Complete" reports, and track your balance sheet by class.

-

QuickBooks Enterprise is the most flexible version, giving you all the features of Premiere, plus more. With Enterprise, you get a new level of control over user access � or who else can access your files, inventory management, the ability to access your files anywhere and any way, expert support, online backup, data protection, and more. For anyone considering Enterprise, Intuit offers a free test drive on their website, so you can see all that it can do.

Getting the Most Out of QuickBooks

Unlike other software programs you may purchase, QuickBooks is not one that you are going to be able to install and use within just a couple of minutes. QuickBooks is an accounting software program for businesses, so you will be asked to enter information about your business's accounting method, bank accounts, etc., before you are able to use and benefit from the program.This may take a few hours. However, it is important to take the time to do it right. Inaccurate or missing information can, and probably will, lead to inaccurate accounting.

Here's another thing to remember. Once you get everything installed and entered, you are going to be overwhelmed with all the features QuickBooks has. The best advice to you is to focus on the features you need. Don't worry about the rest.

If you are a consulting business, for example, you won't need to worry about inventory or entering it. You may just have to worry about invoices, payments from customers, and payments to vendors.

Let's use another example. Let's say you own a coffee shop. For this, you may need a little more. You may need to learn how to do sales receipts, bills from suppliers, payments to vendors, and employee payroll, just to name a few.

Focus on using the features you need. If you want to play with other features, just to see how they work, that's fine.

Other Tips for Using QuickBooks

It is highly recommended, no matter how awesome QuickBooks is, that you outsource your payroll. That is, of course, unless you are already an accountant or have superior accounting abilities. Outsourcing your payroll will cost a few thousand per year.

Payroll is one of the most complicated areas of QuickBooks. You will have fewer headaches if you just outsource it. It is easy to make mistakes with payroll. Couple that with payroll being one of the most complicated sections of QuickBooks, and it could spell fines and penalties from the IRS.

Also, you may want to have your accountant or a CPA go through QuickBooks with you just to make sure you are entering everything correctly. We promise. But you want to make sure you are entering the correct numbers in the correct places.

Produce a profit and loss statement and a balance sheet in QuickBooks. Do this regularly. It will help you determine your profitability. It will also show you if you are doing your accounting correctly. For example, your balance sheet will match your bank statement.

You will install your QuickBooks software as you would any other software program. Follow the instructions that pop up on your screen. You will be able to choose where the program will be saved on your hard drive, as well as other common aspects.

If, for some reason, you have problems during installation, or the program does not function properly once it is installed, here are some tips that will help:

1. Make sure the software is compatible with your computer and your operating system. It should be, and this should never be a problem.

2. Uninstall the software by going to the Control Panel on your computer, then Programs and Features. Find QuickBooks, then uninstall it.

3. Reboot your computer. This is important for a fresh install. If you try to re-install without rebooting, you may have the same problems all over again.

4. Re-install the software.

If you still have problems at this point, you can do some things to help eliminate the problem. These things include running Scandisk on your computer, defrag, and also making sure there aren't any viruses. If nothing else works, visit the Intuit website for help.

Preparing for QuickBooks Setup

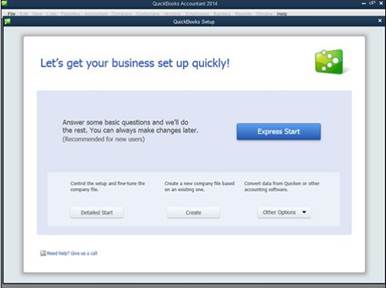

When you first start QuickBooks, the program will let you know how it will use your Internet connection to update the program. Click the button to okay it. You will then see the No Company Open dialog box.

Click the Create a New Company button.

You will then see this message:

In the dialog box pictured above, you will see setup options. There's Detailed Start. With Detailed Start, you can have more control over the setup. However, this is not recommended, unless you are an advanced user. There's also an option that will allow you to create a new file from an old file, and another option to upgrade from another accounting system.

We are going to click the blue Express Start button.

Getting Ready to Use QuickBooks

If you have used previous versions of QuickBooks, you know how easy setup can make getting started.

It is going to take a while to get QuickBooks set up to use. However, there are some things you can do to prepare that will save time. We are going to cover those for you in this article, before we walk you through the setup process.

First:

1. Decide on a conversion date, or the date that you convert from the accounting system you were using to QuickBooks.

2. Have a trial balance as of the conversion date. We'll talk about that in just a minute.

3. Collect things you will need or want to have close by for the interview. Don't worry. We are going to provide a list.

Picking a Conversion Date

You can pick a conversion date using one of these three methods:

1. Convert at the beginning of the calendar year. This makes the most sense and is, by far, the best way. In fact, we recommend it. It requires less work, and all your information for the calendar year will be in one accounting system instead of two.

2. You can convert at the beginning of a month or quarter. This can be a beast to do, because you have to enter your year-to-date income and expenses from the old system into the new. It is kind of like double the work, since you did all of it already in the old system.

3. You can convert when you feel like it. It is going to be a lot of work, but you can do it.

The Trial Balance

A trial balance simply lists your assets, liabilities, and owners' equity account balances. It also includes the year-to-date income and expense numbers for the conversion date. This may sound like a daunting task, but it is really not. If you are currently using Quicken or Simply Accounting (by Computer Associates), it may be able to produce a trial balance for you.

Your trial balance should show all of your account balances for the day when you start to use QuickBooks. If you are using another accounting system, or this is your first time ever using one, here's how you get those balances:

1. Determine your cash balance by reconciling your bank accounts. This must be the balance on the conversion date.

2. To get an accounts receivable (or money owed to you) balance, total up unpaid invoices from customers.

3. To get asset account balances, you must know the original cost of the asset. If they are depreciable fixed assets, you will need the accumulated depreciation amount, or the total amount that you have already depreciated the asset.

4. To get your liability account balances, have the amount that you owe on each liability handy.

There's no need to fuss with equity accounts. QuickBooks will generate the balances for you by figuring out the difference between your assets and liabilities.

What You Need

Once you complete those things, it is time to gather the information you will need. We have included a list, below, for you to use as a guide. Although the gathering of the information may be time-consuming in itself, it is important that you take the time to do it.

-

The federal tax return from last year.

-

Copies of the most recent state and federal payroll tax returns.

-

Copies of unpaid invoices.

-

Copies of unpaid bills.

-

A detailed list of your inventory.

-

Copies of the prior year's W-2 and W-4 statements.

-

Details of any payroll tax deposits.

-

A list of ALL transactions for the past year, including sales, purchases, and payroll transactions.

Using QuickBooks Express Setup

QuickBooks Express Setup allows you to set up your company to use QuickBooks in just a few simple steps. It will guide you through the basics, asking you for the information it needs.This includes company information, contact information, and also products, services, and bank accounts if you want to go ahead and enter it.

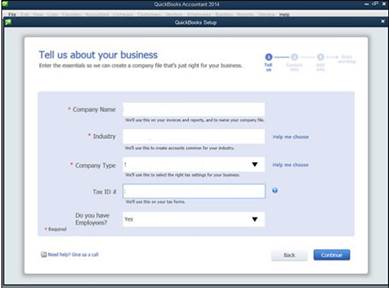

Below is the first window you will see. You will be asked to enter some basic information about your company.

This is the information you will be asked to enter:

-

Company Name. This will be the name of the file that you are creating. It doesn't have to be your legal company name.

-

Industry. By telling QuickBooks your industry, QuickBooks will provide you with a sample chart of accounts (for some industries), as well as some ready-made items you can use when invoicing customers and buying products or services from vendors.

-

Company Type. This will help QuickBooks create equity accounts used for tax preparation. If you need help selecting a company type, click Help Me Choose.

-

Tax ID#. This will be used when processing payroll.

-

Do You Have Employees? Choose Yes, No, or No, but I might in the future.

Click Continue when you have entered all information.

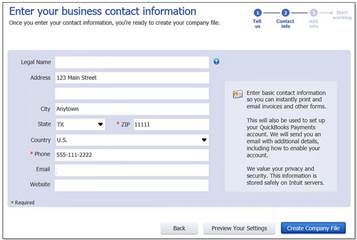

In the next window you see, you are going to continue entering information.

Enter the following information in the dialog box that looks like the one above:

1. Enter the legal name for your business. This is the name that will be used with your payroll.

2. Enter contact information for your business. This includes the address and phone number. Please note that the zip code and phone number is mandatory information you must enter. It is this information that QuickBooks will use to enable you to receive payments online from customers. Plus, more information will be sent to you in the email address you provide.

3. When you are finished, you can click the Preview Your Settings button. When you do this, you will see tabs that will allow you to see the Features Selected, Chart of Accounts, and Company File Location that QuickBooks recommends for you, based on the answers you gave in the first step.

4. Click OK to close the Preview Your Settings box.

5. Click the create Company File button to go to the next steps.

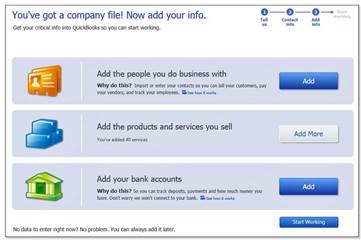

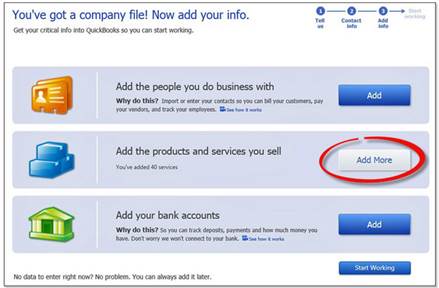

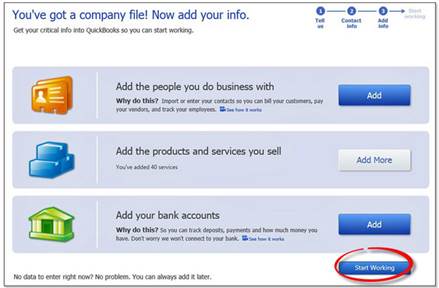

Next, you will add info into QuickBooks, such as the people you do business with, products and services, and bank accounts. You can skip these steps if you want by clicking the Start Working button, as shown below. However, we are going to start adding information.

Adding Customers, Vendors, and Employees

You will be able to add customers, vendors, and employees as you use QuickBooks. However, it is easier to add your current customers, vendors, and employees during setup.

Click the blue Add button that appears to the right of "Add the people you do business with."

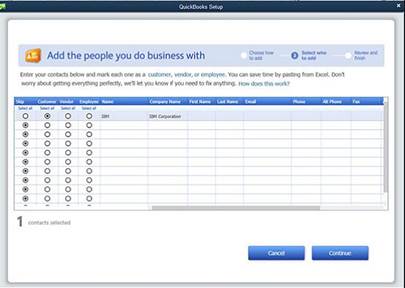

QuickBooks will ask if you have contact names and addresses stored somewhere else, such as in Outlook or Gmail. You can import these into QuickBooks.

Click the appropriate button, then follow the instructions. You can also paste from Excel, or enter names/addresses manually.

The Add People You Do Business With dialog box will let you describe the names and addresses you have entered.

In the dialog box pictured above, you can add the people you do business with. You can also describe your people as customers, vendors, or employees.

Click Continue when you are finished.

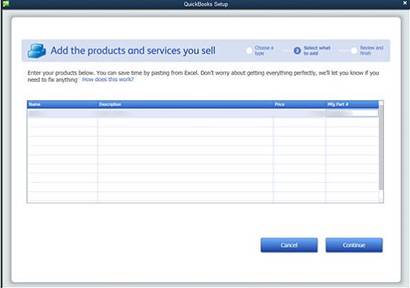

Adding Your Products and Services

You can also add the stuff you sell to QuickBooks. To do this, click the button to the right of "Add the products and services you sell" (as shown below).

In the Add Products and Services You Sell dialog box (pictured below), you can add a name, description, and price for the things you sell.

Click Continue when you are finished.

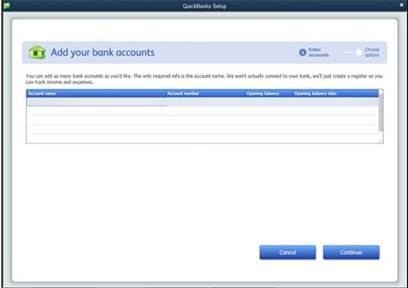

Adding Bank Accounts

To add bank accounts, click the button to the right of "Add your bank accounts," as shown below.

You will then see the Add Your Bank Accounts dialog box.

In this window, enter the bank accounts for your business, their names, and account numbers, as well as the conversion date and the actual conversion date.

When you are finished, click the Continue button.

Now you can click the Start Working button. This will take you to the QuickBooks interface.

Finishing Setup of QuickBooks

The setup we completed in the sections above get you ready to use QuickBooks. However, for it to operate as an efficient accounting program, there are three other things you will need to do:

1. You will need to describe your inventory, receivables, and payables in QuickBooks.

2. You will need to describe your YTD revenue and expenses.

3. If you use accrual-based accounting, you will have to make an adjustment.