When working with clients, loan officers have two major responsibilities:

1) They evaluate an applicant's financial and credit histories against loan amounts requested and based upon such findings render a decision as to whether or not to grant a loan.

By definition, a Loan Agreement (LA) is a contract entered into by and between a lender and a borrower. Stipulating the terms of a loan, outlined within the LA are provisions, specifically referred to as "representations and warranties", which serve as assurances that both parties have complied with the required conditions of the loan.

The loan agreement contains the "representations and warranties" of the borrower. These are your promises to the bank that you've complied with certain conditions.

Typically, loan agreements are characterized in one of two ways, either by the type of lender or by the type of facility.

When categorizing loan agreements by the type of lender, there tends to be two subdivisions:

� Bilateral loans.

When categorizing loan agreements by the type of facility, there also tends to be two categories:

� Term loans.

� Revolving loans.

Essentially, term loans are structured in such a way that they are repaid within set number of installments paid out over the course of the loan.

Note: Some lenders apply a charge for early settlement (also known as an early redemption penalty) should the borrower repay the loan in full prior to the agreed upon end date. Potentially, this penalty can add an additional month or two of interest.

Within the two types of loan categories (term and revolving) various subdivisions exist, for instance, interest only loans and balloon payment loans. Furthermore, the loan can also be subcategorized based upon whether it qualifies as a secured loan or as an unsecured loan and whether the rate of interest is fixed or floating (based on an adjustable rate).

Because there is no mandated loan agreement form, they tend to vary dramatically based upon the country of origin. Yet, despite the wide ranging differences, loan agreements generally tend to encompass the following components:

-

References to contact, their phone numbers and addresses.

-

Definitions and interpretations of provisions.

-

Facility and purpose.

-

Required conditions of the loan.

-

Repayment provisions.

-

Prepayment and cancellation provisions.

-

Interest amounts and interest earning periods.

-

Payment provisions.

-

Representations on the part of the borrower.

-

Covenants of the borrower.

-

In the event of default, what will occur and what can be done.

-

Provisions for penalties and liquidated damages

-

Calculation Formulas

-

Provisions for lenders' fees

-

Provisions for lenders' expenses.

-

Security provisions.

-

Amendments and waiver provisions.

-

Covenants relating to changes in party ownership.

-

Set-off clause (seizure of assets).

-

Appointment of a process agent.

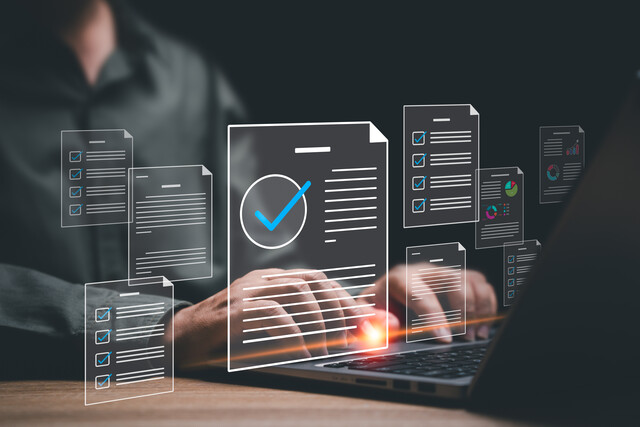

Note: At this point of the loan finalization process, the lender should already have all of an applicant's financial documents. However, should additional materials, such as investment filings, be required, it is the responsibility of the loan officer to impress upon the applicant the need to submit those in a timely manner.

We probably have seen promissory notes at some point in our lives.

The promissory note details the principal and interest amounts owed, when payments are due, and it outlines the events that would allow the bank to declare your loan in default. This is shown in the following example.

On this date of [DATE], in return for valuable consideration received, the undersigned borrower[s] jointly and severally promise to pay to [LENDER'S NAME], the "Lender", the sum of $[DOLLARS] Dollars, together with interest thereon at the rate of [RATE] percent ([RATE] %) per annum.

In the loan package, the all important promissory note is used to specify the terms of repayment, including principal and interest, the length of the loan, late fees, and whether a prepayment penalty needs to be assessed. In addition, it also describes the circumstances under which the borrower may wind up in default, and what happens in the event of such a default.

In the case of small business loans, the guarantee or surety agreement is the borrower's promise to the bank that, if the borrower's business entity is unable to repay the money, they will personally repay it from their personal holdings.

Since most startup businesses have not amassed impressive assets or racked up sufficient operating histories, lenders frequently require the loan be backed up with personal assets because it presents too great a risk without such .

Truth-in-Lending (TIL), a broad based term used in a variety of instances requiring public acknowledgements be made to consumers, also has a place within formalized lending practices. The Truth-in-Lending Act requires "clear and conspicuous" disclosure of the key provisions to borrowers relating to their loans.

Within the lending arena, truth in lending applies to a range of disclosures including: APR whereby it must be listed more prominently than other disclosures and ARMs. Also TIL covers credit cards and those additional revelations that need to be publicly revealed within a specified time period.